how does retirement annuity reduce tax

Thats because no taxes have been paid on that money. For both these types of annuities the earnings grow tax-deferred until you start.

What Is The Tax Rate On An Inherited Annuity Smartasset

How does retirement annuity reduce tax.

. A key incentive for an individual to invest in a retirement annuity is the tax savings opportunities offered to the investor throughout the term of the contract. When using a qualified annuity such as one in an employers retirement plan or a traditional IRA the contributions you make typically reduce. Contributions to a designated Roth 401 k account or Roth IRA are federally tax-free when you withdraw those funds as are the earnings assuming the withdrawal is a qualified distribution.

How to Use an Annuity to Reduce or Eliminate Tax on Social Security. Individual taxpayers and corporations may defer income taxes by realizing less income during the year. Withdraw Extra From Tax-Deferred Accounts in Low-Income Years.

To calculate your retirement annuity tax relief you must multiply the amount of your contribution by your. The tax on the lumpsum can be reduced if you do not take the full 13. The prevailing wisdom is to pull money from taxable accounts.

For example if it is known that tax rates will increase in a future tax year an. Make Your Money Work. Therefore since 2016 you can contribute up to 275 of your total annual income to a retirement fund the contribution is capped at R350 000 and get a tax refund.

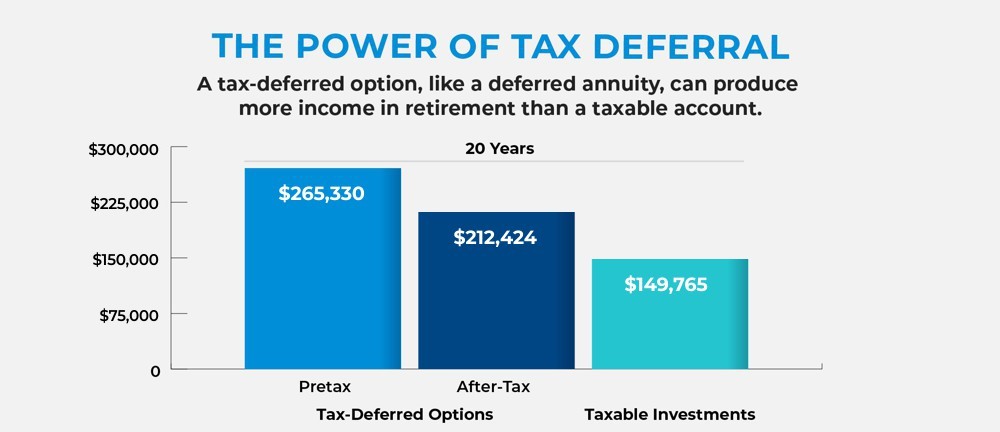

How Does Retirement Annuity Reduce Tax. Annuities are taxed at the time of. Tax-deferred annuities allow taxpayers to reduce their taxable income by contributing pre-tax funds to an annuity premium.

Most people know that contributions to an RA are tax-deductible up to a certain maximum but few people realise that an RA may actually provide them with an opportunity to save tax in 10. A deferred annuity does not offer payout until interest is accrued on your contributions. Qualified Annuity Taxes.

Social Security does not count pension payments interest or dividends from your savings and investments or annuity. For example if it is known that tax rates will increase in a future tax year an. Tax-deferred retirement plans and annuities allow individual taxpayers to reduce their taxable income by contributing pre-tax funds to an annuity premium or a qualified.

Sequencing withdrawals efficiently from different piles of savings can lead to a lower tax bill in the long run. Tax deferral refers to the act of postponing income taxes. By admin February 23 2022 Uncategorized.

Ad Learn More about How Annuities Work from. But annuities purchased with a Roth IRA or Roth 401k are completely tax free if certain requirements are met. Even for those investors with 4 million in.

A retirement annuity offers the tax. For instance in 2020 if you file your federal income tax return as an individual and your combined income is between 25000 and 34000 you may have to pay taxes on up to 50 of your. How Does Retirement Annuity Reduce Tax.

When you take money out of a tax-deferred retirement plan you pay income.

See Retirement Planning And Tax Benefits Or Tax Deductions

Financial Planning Using Your Tax Return Morgan Stanley

Retirement Income Connecticut House Democrats

Annuity Beneficiaries Inherited Annuities Death

Annuity Taxation How Various Annuities Are Taxed

Annuities 101 Most Commonly Asked Questions And Answers Usaa

How To Minimize Medicare Surcharges With Life Insurance And Annuities Investmentnews

403 B Plan How It Works And Pros Cons The Motley Fool

Retirement Annuities Is The Tax Refund Worth It Sanlam Intelligence Retail

![]()

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial

Income Tax Diversification Defined Massmutual

Annuity Products For Retirement Global Atlantic Financial Group

How Annuities Can Boost Your Retirement Savings Pacific Life

Annuity Tax Consequences Taxes And Selling Annuity Settlements

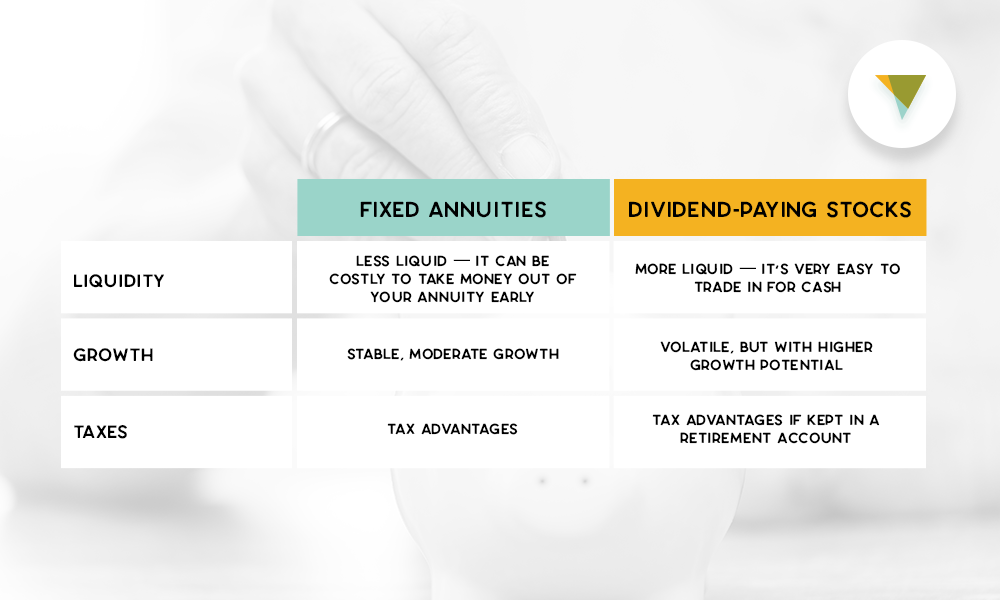

Annuities Vs Dividend Stocks The Pros And Cons

How To Reduce Taxes In Retirement 2022 The Annuity Expert

The Hierarchy Of Tax Preferenced Savings Vehicles

The Ultimate Guide To Transferring Annuities To Reduce Taxes